Interest rate investment with pace. Learn more about how the products work.

How it works in detail

Interest rates are low and stock markets are moving sideways. Difficult times for choosing the right investment. In these phases, it is worth looking at alternative investments.

Express Reverse Convertible Protect products offer fixed interest payments regardless of the development of the share price.

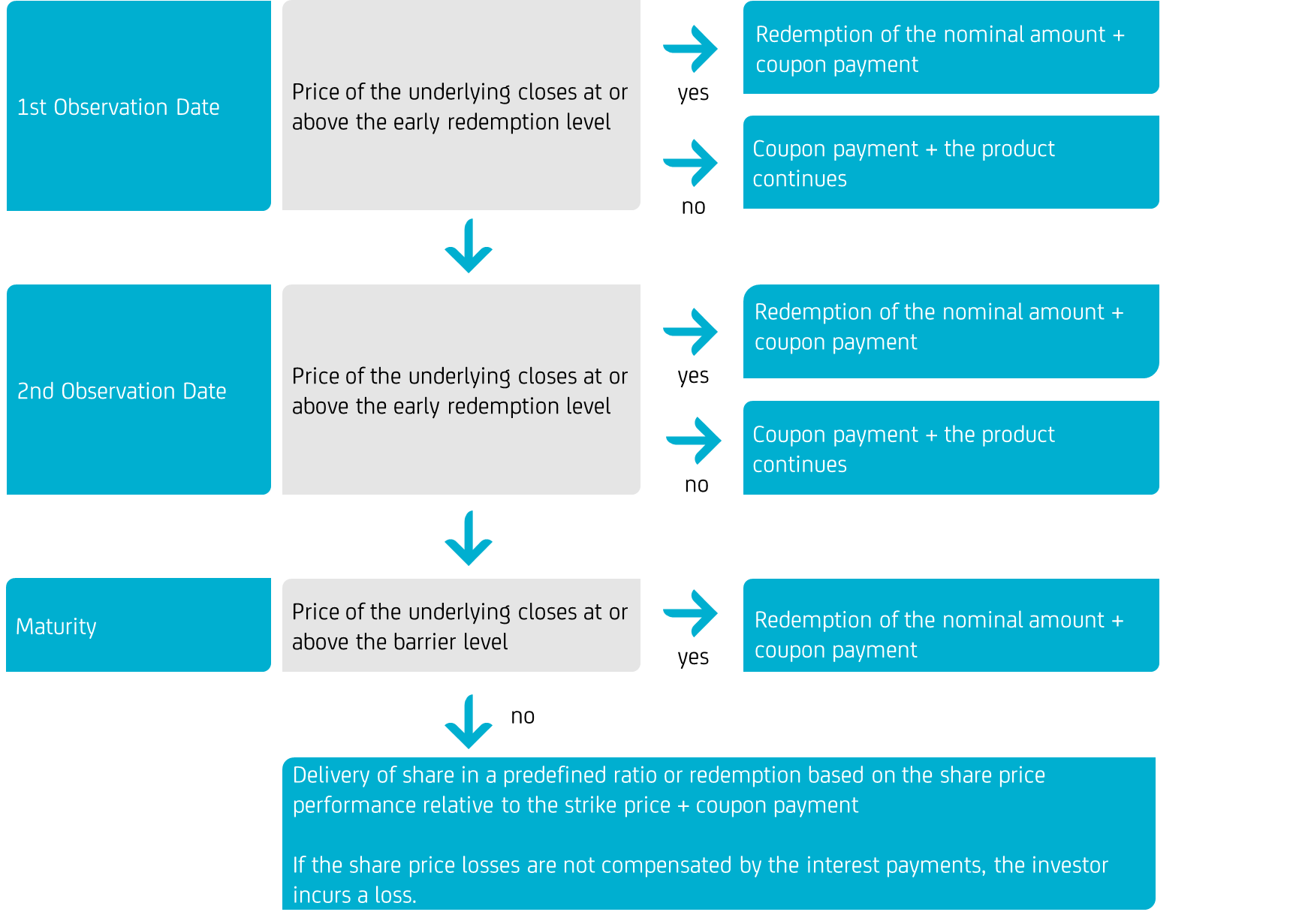

In addition, early redemption of the nominal amount of EUR 1,000 per note is possible on regular early redemption dates (Express). This is the case if the price of the underlying on the respective early observation dates closes at least on the respective early redemption level set at the initial observation date.

If there is no early redemption, at the end of the term the integrated barrier partially protects against a decling price of the underlying. The barrier level is also determined at the beginning of the term.

You can find our range of Express Reverse Convertible Protect here:

Chances

- Interest payments regardless of the development of the share.

- Barrier partially protects from a decline in the share price

Risks

- The investor is exposed to the risk of share price movement.

- The return is limited to the respective coupon payments.

Redemption at maturity

Unlike the interest payments, the redemption of the nominal amount depends on the performance of the share price.

If there is no early redemption of the nominal amount, there are two scenarios at the end of the term.

- If the price of the share is at least equal to the barrier at the end of the term, investors receive a redemption of the nominal amount.

- If the share price is below the barrier, the investor will receive a fixed number of shares or a cash payment based on the share price performance relative to the strike price. Both the total value of the delivered shares or the cash payment can be significantly lower than the initial selling price of the Reverse Convertible Protect. If the share price losses are not compensated by the interest payments, the investor incurs a loss.

In the event of bankruptcy, i.e. over-indebtedness or insolvency of the issuer, there may be losses up to total loss of the invested capital.

The following graphic shows an example of the redemption profile of a Express Reverse Convertible Protect.